Inflation Soars to 3.5%, Highest in a Year—How It Affects Your Wallet

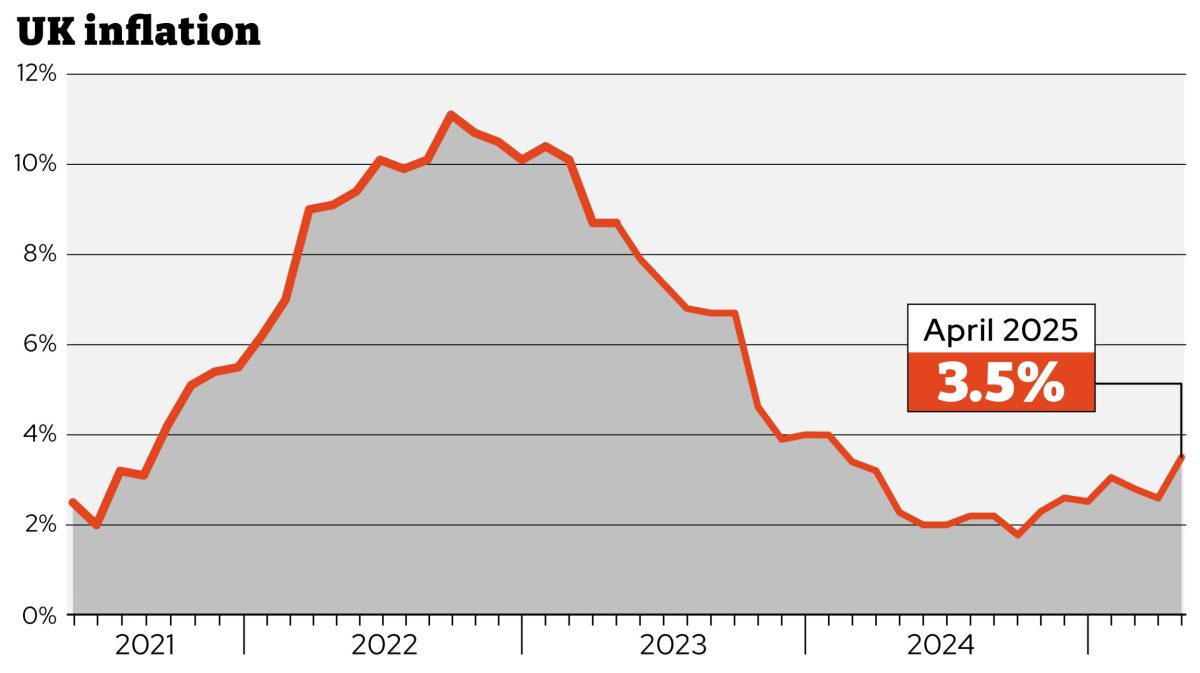

Inflation increased to 3.5 percent in the year leading up to April, as reported by the Office for National Statistics (ONS) on Wednesday.

The Consumer Prices Index (CPI) measure of inflation is now at the highest level it has been for over a year. The figure was 4 per cent last January and 3.4 per cent the following month. It was 3.2 per cent last March.

The number announced today is significantly higher than the previous one. Bank of England’s 2 percent target level.

Economists had broadly forecasted that inflation would climb – largely because of a boost in energy prices Last month – although the Bank of England anticipated it would reach 3.4 percent.

The core CPI, which measures inflation without energy, food, alcohol, and tobacco costs, increased by 3.8 percent in the year ending April 2025, compared to a rise of 3.4 percent for the period ending March.

The inflation for food and non-alcoholic drinks was 3.4 percent, an increase from the 3 percent recorded in April.

ONS Deputy Director-General Grant Fitzner stated: "Substantial rises in household bills led to a sharp increase in inflation.

Natural gas and electric power costs increased this month relative to the significant declines seen during the same period last year, owing to modifications made by Ofgem. energy price cap .

“Water and sewerage bills also rose strongly this year, as did vehicle excise duty, which all pushed the headline rate up to its highest level since the beginning of last year.”

Chancellor Rachel Reeves stated: "These numbers disappoint me as I'm aware that the burden of living costs continues to press heavily upon workers."

We have come far from the high-double digit inflation during the last government, yet I am committed to pushing harder and quicker to increase funds in citizens' wallets.

How do you think inflation will evolve in the coming years?

It’s broadly anticipated that inflation will remain elevated for the remainder of this year; however, experts differ on just how high it might climb.

Pantheon Macroeconomics and others propose that the number might reach 3.7% by September, yet it will remain over 3% until next spring.

However, economists like Andrew Sentance argue that it might climb up to 5 percent.

This month, the Bank of England reported in a document that past hikes in energy costs will probably cause CPI inflation to rise starting from April.

How will this affect interest rates?

Greater inflation indicates that prices are increasing faster than they would under normal circumstances, which might lead the Bank to take action accordingly. interest rates higher for longer.

The current interest rate stands at 4.5 percent following reductions in February and May, with a hold announced in March.

Even though inflation is still well above the Bank’s 2 per cent target, there is an expectation that there will be additional interest rate decreases later this year .

However, this is not assured. On Tuesday, Bank’s Chief Economist Huw Pill stated that the institution had been reducing interest rates at an overly rapid pace.

Specialists have indicated that interest rates ought to be reduced even with the increase in the inflation rate.

Thomas Pugh, an economist with RSM UK, commented: "The surge in April's inflation is not expected to alter the likelihood of reducing interest rates. Our primary forecast remains predicting rate reductions at all remaining meetings this year, which would result in two additional cuts and an ending interest rate of 3.75%."

How will this impact mortgages, savings, and pensions?

Mortgages

Mortgages do not have their purchasing power directly impacted by inflation, even though numerous goods are influenced by the central bank’s base interest rate, which itself can be swayed by inflation.

Tracker products and standard variable mortgages change directly when interest rates change.

Fixed mortgages They usually keep an eye on swap rates, which are based on long-term forecasts of where the base rate might head.

Mortgage rates are generally anticipated to decline over the course of this year; however, they have seen a slight increase recently.

Considering Wednesday’s inflation rate was above what many economists anticipated, there's a possibility that mortgage rates might not decrease as rapidly as expected by some experts. Additionally, certain lending institutions may even decide to raise their interest rates.

Savings

High inflation is bad news for savers as it erodes the value of money held in the bank. Therefore, the lower the rate, the better the news for savers.

The impact of inflation on the Bank’s interest rate likewise influences savers due to the base rate's effect on savings rates.

Specialists think we have moved "beyond the apex" of this situation. savings , even though there are some elevated rates that can still be seized.

For instance, Chip provides a straightforward-access cash ISA with a rate of 4.85 percent – comfortably above inflation levels – although this does include a temporary bonus rate.

Atom Bank provides a savings account with an interest rate of 4.75%, but this rate decreases during months when withdrawals are made.

Pensions

Rising inflation can erode pensioners’ savings.

For instance, if you're 67 years old and planning to retire next year with a savings pot of £87,500—the approximate amount an individual over 50 might accumulate by retirement, based on figures from Pension Bee—and both inflation and investment returns stay steady at 3% each, your nest egg would grow to about £90,125 by the time you retire.

However, in practical terms, it would hold precisely the same value as it does now, since inflation has eroded the possible increase.

Another consideration is how inflation affects annuity rates .

Annuities offer a guaranteed annual income in retirement They provide an option besides withdrawing funds from a pension pot , which might eventually be depleted, especially if someone lives longer than anticipated after retirement.

Although they've fallen out of favour recently, increasing interest rates have boosted the yearly returns one can earn from investments.

However, for retirees considering this option, timing could be crucial. As the Bank is anticipated to reduce interest rates even more, those rates might drop soon.

Post a Comment for "Inflation Soars to 3.5%, Highest in a Year—How It Affects Your Wallet"